NPV might not be helpful or useful for comparing investments of drastically different sizes, or projects of different sizes. To do that, you’d divide the company’s net present value by the number of outstanding shares in the company to get this number. If the net value per share is higher than the stock’s current market price, then the stock could be considered a good buy. On the other hand, if the net value per share is below the stock’s current market price that suggests you might lose money if you decide to buy in. Get instant access to video lessons taught by experienced investment bankers.

Example: Let us say you can get 10% interest on your money.

The cost of capital guides the company’s capital structure decisions, helping determine the optimal mix of debt and equity financing. It represents the rate of return at which the project breaks even, helping to gauge its potential profitability. Net present value is even better than some other discounted cash flow techniques such as IRR. In situations where IRR and NPV give conflicting decisions, NPV decision should be preferred.

What is the importance of net present value in financial decision-making?

If it is new to you, we hope our lesson in plain English will help you understand quickly and be able to start to use these methods of measurement right away. If you work in finance you will inevitably spend time calculating and reviewing the return on different investments. Some of the most common methods for calculating these valuations are net present value (NPV) and Internal Rate of Return (IRR). The main use of the NPV formula is in Discounted Cash Flow (DCF) modeling in Excel. In DCF models an analyst will forecast a company’s three financial statements into the future and calculate the company’s Free Cash Flow to the Firm (FCFF). You can use NPV to evaluate stocks and other securities, including alternative investments, based on your time frame and projected profits.

Cash Flow and Liquidity Management

So Bob invests $100,000 and receives a total of $200,000 over the next ten years. Remember the $200,000 is not discounted to adjust for the time value of money. Comparing NPVs of projects with different lifespans can be problematic, as it may not adequately account for the difference in the duration of benefits generated by each project. NPV allows for easy comparison of various investment alternatives or projects, helping decision-makers identify the most attractive opportunities and allocate resources accordingly. NPV can be used to assess the viability of various projects within a company, comparing their expected profitability and aiding in the decision-making process for project prioritization and resource allocation. How about if Option A requires an initial investment of $1 million, while Option B will only cost $10?

Calculate Present Value of Each Cash Flow

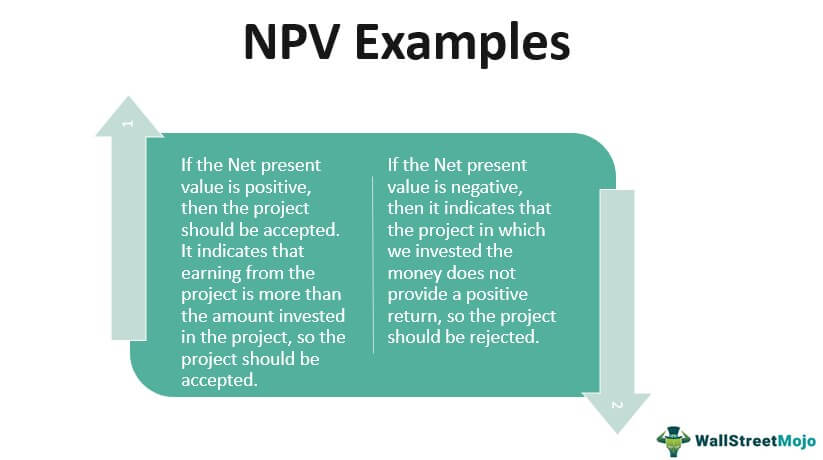

In practice, NPV is widely used to determine the perceived profitability of a potential investment or project to help guide critical capital budgeting and allocation decisions. Net Present Value is a critical tool in financial decision-making, as it enables investors and financial managers to evaluate the profitability and viability of potential investments or projects. The profitability index is the ratio of the present value of cash inflows to the present value of cash outflows. A profitability index greater than one indicates a profitable investment or project. Finally, subtract the initial investment from the sum of the present values of all cash flows to determine the NPV of the investment or project. One drawback of this method is that it fails to account for the time value of money.

Payback Period

- It equals the present value of the project net cash inflows minus the initial investment outlay.

- • Net Present Value (NPV) measures the difference between the present value of cash inflows and outflows over time.

- Though the NPV formula estimates how much value a project will produce, it doesn’t show if it’s an efficient use of your investment dollars.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. By comparing NPVs, decision-makers can identify the most attractive investment opportunities and allocate resources accordingly. The way a company finances its operations, through debt or equity, influences its risk level and flexibility in pursuing growth.

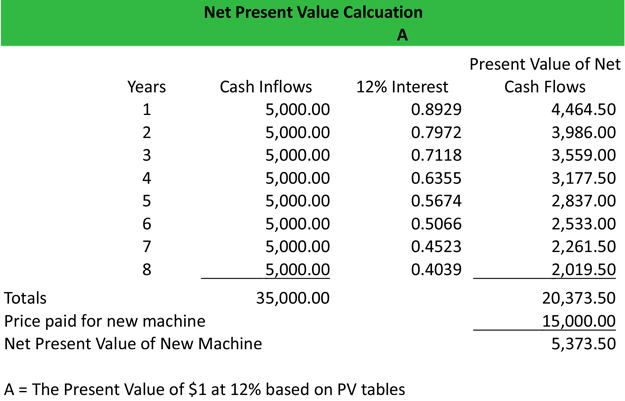

Calculate the net present value of a project which requires an initial investment of $243,000 and it is expected to generate a net cash flow of $50,000 each month for 12 months. The discount factor is the cost of borrowing money or the rate of return payable to investors. It’s specific to the business in question and usually set by the Chief Financial Officer. Your company is interested in a project that will generate cash inflows of $300,000, $350,000, $370,000, $330,000 at the end of each year for 4 years. The project will require purchase of fixed assets of $550,000 which is to be depreciated using straight-line method with a salvage value of $150,000.

This makes sense because they want to see the actual outcome of their choices when interest expense and other time factors are taken into account. Net present value is a financial calculation used to determine the present value of future cash flows. It takes into account the time value of money, which means that a dollar today is worth more than a dollar received in the future. Finally, a terminal value is used to value the company beyond turbotax teacher discount education discount the forecast period, and all cash flows are discounted back to the present at the firm’s weighted average cost of capital. If the net present value of a project or investment, is negative it means the expected rate of return that will be earned on it is less than the discount rate (required rate of return or hurdle rate). The present value of net cash flows is determined at a discount rate which is reflective of the project risk.

Calculate the net present value of the investment if the discount rate is 18%. Working out the net present value of a project or investment starts simply by adding together all the present values of the relevant future cash flows. Then you deduct the total amount of investment – cash outflows – to give you the Net Present Value. Present value or PV is the present value of all future cash inflows over a set period of time.